Views from the balconies of the soon-to-be completed Betula House!

MONTHLY UPDATE

Dear Investors and Valued Partners,

This a consolidated update for all our business, with a brief update on our pipeline and what we are seeing in the market. We send this each month to keep all of our investors, partners and friends up to date.

Highlights from the past month for us include:

-

Getting very close on Betula House – permanent power connected, final inspections scheduled for 4/11-15, and about 65% pre-leased all at or above pro-forma rents

-

Achieving the planned 10% cash yield milestone for our first acquisition fund, Fraxinus Apartments for Portland

-

Signing our first two ‘third party’ property management contracts, leveraging our market-leading capabilities with in eco-housing (small apartments)

Please read below for some market musings and more detailed updates on each of our projects.

Investors — please note that our 2022 annual reports and K1s are now on your portal. Click here to log in.

Market notes — housing supply and demand

Underproduction of housing has finally made its way into popular discourse. Political leaders are finally starting to make reforms to housing regulation that will allow supply to start to meet the demand. But is it too little, too late?

The reforms proposed are largely of the “missing middle” approach — allowing for duplexes in residential neighborhoods. A slight increase on already very-low density that will take decades to have meaningful impact.

In the mean time, the largest source of our housing supply in our region — urban apartments — is slowing to a crawl. There has been a lot of press about how multifamily construction is at an all time-high, but this is largely a sun-belt trend. Production in our home market of Seattle has cratered.

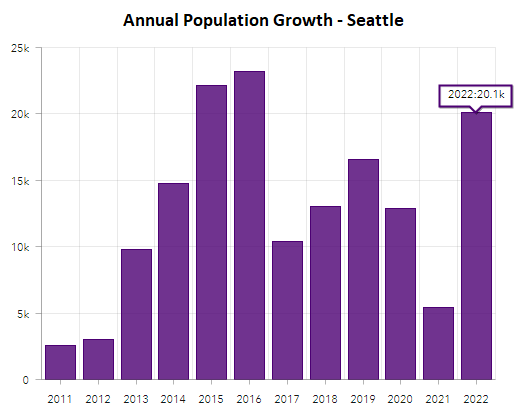

Below is a chart showing that 20,100 people came to Seattle last year. Given our current 2% vacancy rate and the breakneck pace of our pre-leasing at Betula, we see they are still coming in 2023.

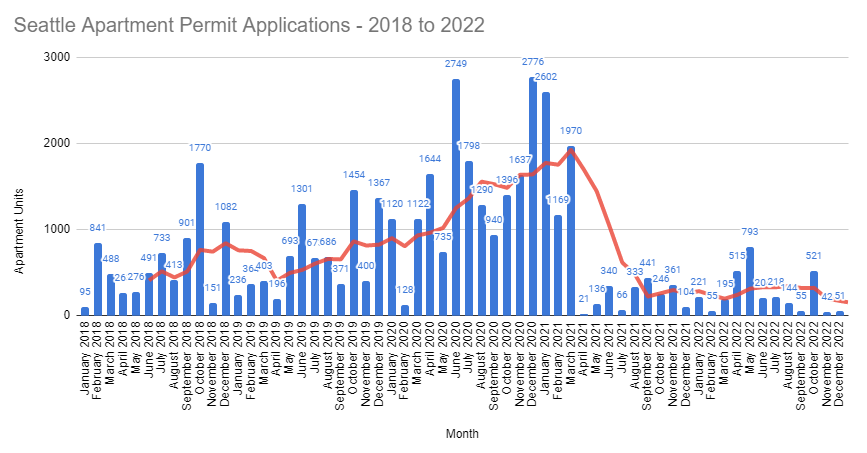

Below that is a chart showing the permits for new apartments in Seattle. Permits cratered in 2021 right around the time growth started picking up. The proximate cause of that change was likely Seattle’s nation-leading Energy Code which went into effect around then. This well-intentioned law adds about $20-30k per unit for energy efficiency improvements that will never be paid back through lower costs.

The result of this is that without truly drastic action, rents will continue to increase. For a new apartment building to ‘pencil’ in Seattle under the most recent code, rents will need to get to about $2000 for as studio — an increase of about 20%.

The only immediate solution for this to protect renters is more subsidy, and fortunately our leaders appear to see this. The Seattle mayor recently announced a $900M levy that will fund affordable housing.

Longer term, we believe that more naturally affordable models such as ours will be needed, and local governments will need to support them. To that end, we are actively involved in both Seattle and some Eastside cities on eco-housing reforms (what others call micro-housing). Meanwhile, we continue to do what we can to keep costs low and our apartments full to help as many renters as we can.

Cornus House

199-Unit Opportunity Zone project in Tacoma, WA

March began with the tower crane erection, and the subsequent erection of the placing boom. South 25th street was closed for the duration of the crane erection, as several large mobile cranes placed the section’s top one another, with fearless ironworkers making the final pin connections.

Safety is a huge priority during this work, and months of coordination meetings resulted in a smooth install. The placing boom located just West of the tower crane will support concrete pumping to the various tough to access corners of the property. Based on the tight site, and costly street closure fees, the placing boom was the logical choice.

Building footings at the North and Northwest elevations were excavated, formed, reinforced and poured throughout the month. Soils excavated from the footings are segregated to the Southern end of the site, tested, then hauled to the Everett facility. In a tight site, the construction team must balance hauling soils, delivery of reinforcing steel, and crews of 20+ ironworkers.

Betula House

50-Unit Opportunity Zone project in Seattle, WA

Portland operations continue to be good, with the hustle of our team overcoming a very challenging market which has seen population declining. Indeed, through this period we saw rent growth which is testament to Mia and her team.

Let there be light! Seattle City Light installed a new 50′ power pole, transformer gear, brought wire into the building, and have completed energizing Betula. A process that typically is 6-8 weeks, was completed in 3.

With the building energized, the construction team is expeditiously completing the building final inspections. The inspections to complete include right of way, electrical final, mechanical final, landscape final, planning inspection, fire sprinkler final and fire alarm final. Certificate of occupancy will follow the fire alarm final inspection.

We are hard at work on leasing, with strong demand leading us to 65% leased with 2 weeks still left to go. All rents are at or above our pro forma projections. The studios and 1s are going fast. We are seeing less demand for the 2BRs, but we think that as new residents move to town in May they will get snapped up.

Our revised target is 75% leased by opening on April 17th… wish us luck!

Acer House

114-Unit Equitable Opportunity Zone development in Seattle, WA

We are still eagerly awaiting our re-zone decision from SDCI. With the final notice period over, we are hopeful to get this shortly. In parallel we have begun conversations with public and corporate funders, all of whom are committed to Acer’s anti-racist values. We are excited to move forward after a long delay. Despite the headwinds facing development, projects like this still have a good chance of becoming reality.

Fraxinus Apartments Portfolio

108-Unit Eco-Housing portfolio in Portland, OR

Thanks to the in-sourcing of our property management, the Fraxinus portfolio continues to perform. We are very pleased to have reached the milestone of a 10% cash yield for this Fund, and that’s without the refinancing we were hoping for. Our success has not gone unnoticed, and as a result we have agreed to take on property management of 100+ additional eco-units owned by one of our friends and business partners in Portland. This added scale, now almost 230 units overall, will improve our property management operations in Portland for all our residents and investors alike.

Picea Apartments Portfolio

280-Unit Eco-Housing portfolio in Seattle, WA

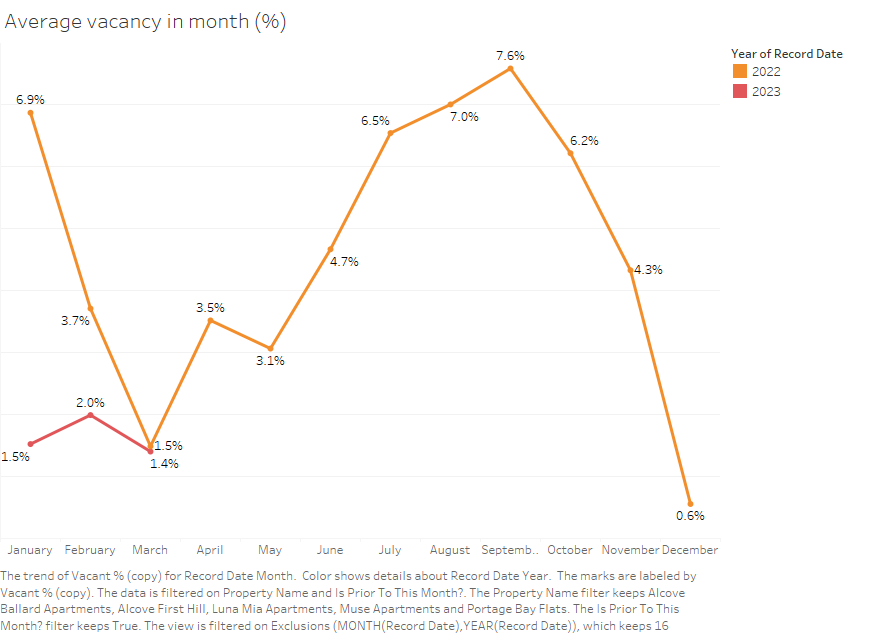

Picea continues to perform well with very low vacancy. We actually hit this milestone last March as well, but then saw a major uptick. Last year’s uptick was casued by the Eviction Moratorium ending and also the acquisition of three other buildings each of which had elevated vacancy at closing.

We think this year we are well positioned to keep occupancy high throughout the year, given we now have stable operations. We continue to invest in minor projects, including adding cooking devices on turns whenever unit power allows.

Vacancy for Picea, 2023 vs 2022

Investment Pipeline

Last month we talked about our development projects. We are in parallel working on two exciting acquisitions.

We have been consistently underwriting opportunities where we think our management capability can add value for residents, with returns our investors will appreciate. Over the past 9 months that has meant making offers far below market, many of which get laughed off.

Finally, we are seeing some traction. We can’t say too much about specific opportunities right now, but we are optimistic about seeing some opportunities later this year.

Thank you!

As always, thank you for your support and please do not hesitate to reach out with any questions!

Ben and the GE/Arboreal team.

Copyright (C) 2023 Great Expectations LLC. All rights reserved

Our mailing address is:

Want to change how you receive these emails?

You can update your preferences or unsubscribe

Recent Comments