Steel mesh reinforcement awaing a mat slab pour later this month at Cornus

Dear Investors and Valued Partners,

This a consolidated update for all our business, with a brief update on our pipeline and what we are seeing in the market. We send this each month to keep all of our investors, partners and friends up to date.

Highlights from the past month for us include:

-

Betula House fully occupied

-

Cornus sub-surface work complete and final prep for slab pour underway

-

Laying the foundation for a 3rd apartment acquisition fund to be launched in the next month or two

Please read below for some market musings and more detailed updates on each of our projects.

Betula House

50-Unit Opportunity Zone project in Seattle, WA

Betula House is now fully occupied. For those of you who haven’t yet done a tour, apologies — there are no more vacants to show. We will get a few back in August.

To get the building full as quickly as possible we did about 40% of the apartments on a short term, furnished basis. We were very pleasantly suprised at the demand for this service, and have expanded it another building where we are doing a partial lease-up.

We have now turned our attention to re-leasing these apartments for the fall. We have done 3 of the 20 leases so far and have good demand.

We are continuing to work on leases for the retail space. We had a false start with one potential tenant, but have a few others we are talking to as well. We hope to have that space leased in the next 1-2 months at which point we will begin our refinancing process.

Our plan is still to have the refi done this fall. This will allow us to retire our high-cost construction debt and start to return cash to investors.

Cornus House

199-Unit Opportunity Zone project in Tacoma, WA

Foundation footings at Cornus

In May we achieved a big milestone, by “bottomingout” the project site. This means the vast majority of soils (over 97%) have been exported, and the foundation footings have been poured. The below grade scope of a construction project carries the majority of the unknowns, and we are happy to be complete.

The following numbers below help illustrate the magnitude of the below grade effort

- Soldier piles placed: 35

- Aggregate piers placed below footings: 398

- Work hours with no lost time incidents: 11,686

- Volume of soil hauled: 11,671 tons, or, 7,529 cubic yards

A tremendous amount of coordination had to take place to accomplish this. Sequencing the removal of contaminated soil, lab testing each batch of soils, placement of shoring walls, placement of aggregate piers drilled to depths up to 50’, digging/placement of building footings, installing below grade plumbing and electrical conduit, inspecting placed waterproofing materials, and then subsequently backfilling soils around the concrete footings. The conductor of the construction orchestra must balance and drive the various trade partners towards successful completion of schedule milestones.

Our major milestone in June will be the “slab on grade” pour which we anticpate doing in a single day on June 22nd. Join us in Tacoma!

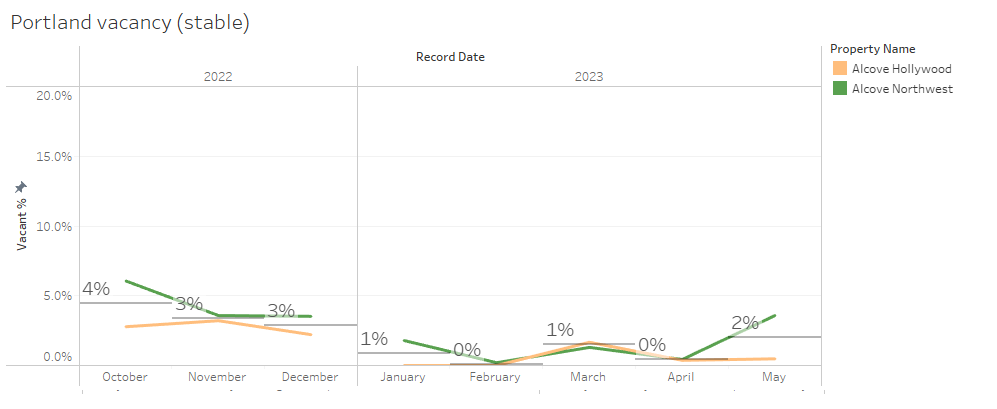

Portland Apartments Portfolio

213 Eco-Housing portfolio in Portland, OR

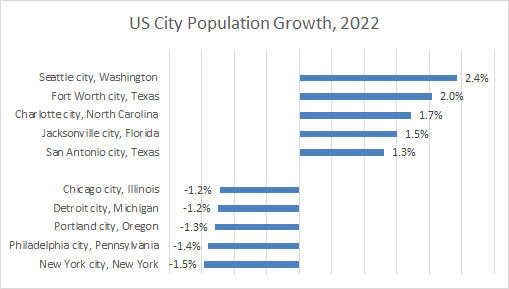

Portland operations continue to be good, with the hustle of our team overcoming a very challenging market which has seen population declining. Indeed, through this period we saw rent growth which is testament to Mia and her team.

US population growth by city, from the US Census May 2023 report

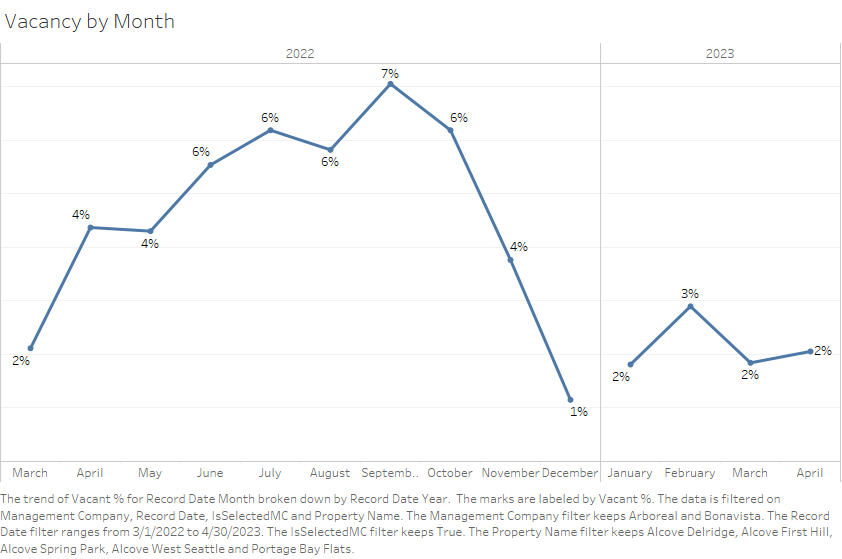

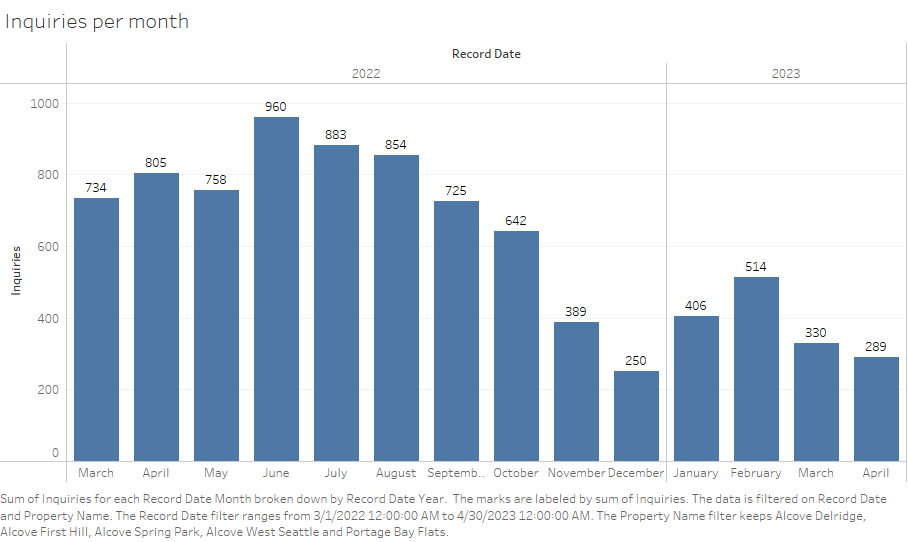

Seattle Apartments Portfolio

567 Eco-Housing portfolio in Seattle, WA

April marks the start of the summer leasing season when many residents in our market start to move. This year we have noticed a rather different pattern than last year, with more people staying in their current housing. This means our vacancy is lower than this time last year, but so are our incoming leads.

It’s too early to call the trend for the peak summer season, but we are making adjustments to adjust to a more competitive market. The critical thing will be to execute well on the leads we do have, so as to avoid prolonged vacancy and maintain cash flow.

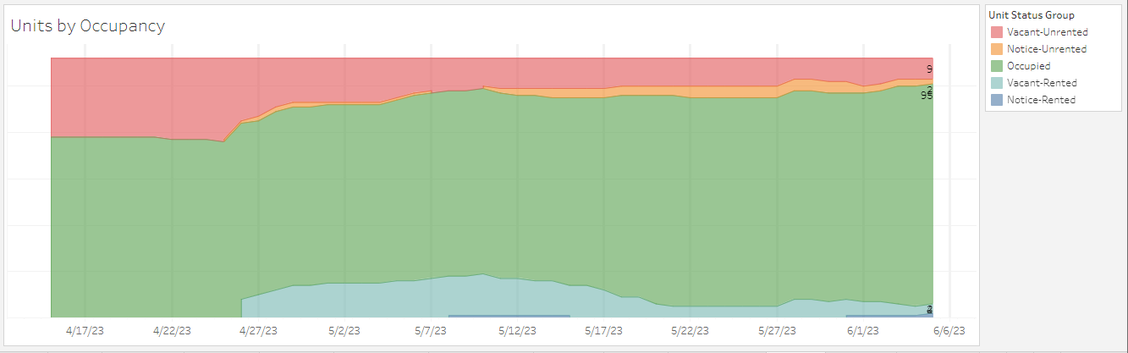

However this season plays out we are confident that we will get more than our fair share of new residents. Below is evidence of our team’s hustle in getting a building we recently took over full within a month of take-over

We recently took over a building for an affiliate of ours that had lasting occupancy issues which we were able to quickly resolve

Acquisition fund

Previewing ‘Thuja Apartments LLC’

We have been tracking the market closely for some time and feel now is the right time to start to acquire apartments. As always, our goal is look for opportunities where we can both deliver affordable rents for residents and strong returns for investors.

Despite the ups and downs of the capital markets, we believe that the right underwriting criteria is a 10% stabilized cash yield on investment. Given the large role of debt in real estate, higher interest rates mean that lower purchase prices are needed to maintain these yields.

We are now seeing several buildings where we think that our return hurdle can be met. These are largely sales where a sale is being forced by family planning or tax reasons. In all cases, the buyer pool is very thin due to the apartments being small — which of course we love.

Our plan is complete our diligence on the first few opportunities and then launch the fund based on those investments. We feel this approach provides both some certainty and confidence to investors but maintains flexibility for us.

Please look for more information on this opportunity in the weeks to come.

Thank you!

As always, thank you for your support and please do not hesitate to reach out with any questions!

– Ben and the GE/Arboreal team.

Mackenzie, our furnished apartment project manager in the last of the apartments she needed to prepare for today’s move-ins!

Recent Comments