Mock-up of new frontage for Columbia Apartments, our recent acquisition

MONTHLY UPDATE

Dear Investors and Valued Partners,

This a consolidated update for all our business, with a brief update on our pipeline and what we are seeing in the market. We send this each month to keep all of our investors, partners and friends up to date.

Highlights from the past month for us include:

-

First acquisition for Thuja, our next fund, closed

-

Two of three retail leases at Betula signed

-

Tremendous effort from our leasing team to keep up with the summer shuffle

Please read below for some market musings and more detailed updates.

Betula House

50-Unit Opportunity Zone project in Seattle, WA

We’re very pleased to have signed retail leases for two of our three spaces. As in other locations, we’ve prioritized keeping our spaces small and working with immigrant and first time entrepreneur groups. We choose business types that need little in the way of “tenant improvement”. Small spaces and limited allowances allow us to keep rents and re-leasing costs low, so we can be more flexible on credit. We view this as a core part of our mission.

We look forward to introducing the tenants to you soon, but they include:

-

A high end nail art salon, owned by female Asian-American entrepreneurs

-

A hair brading studio, owned by two African American sisters. They have been providing their services on a mobile basis and are ready for a physical space.

The 3rd space, a cafe, has had a few LOIs submitted but nothing that quite meets our needs. We have one group now that we are working with about whom we are excited.

We have begun the process of refinancing our construction loans and have received several quotes. We are currently seeing interest rates in the high 5’s with favorable terms due to our affordable housing commitments. Despite the high rates, the above-budget performance of our rentals will allow us to fully refinance the construction loan. We feel very fortunate that we had a low-leverage strategy for the original construction loan.

Cornus House

199-Unit Opportunity Zone project in Tacoma, WA

View from the crane down onto the slab

|

We continued steady progress over the month of July. We poured the level 2 elevated concrete slab, the entry lobby slab, and the L2 columns & stem walls. The 2 story columns at the retail spaces have been poured, formwork stripped and they look outstanding. Formwork has begun for the L3 slab, with an 8/17 pour scheduled. The construction team is also working behind the scenes to coordinate utility scope underneath the right of way with City of Tacoma. A new waterline main will be extended, sewer brought into the property, and power. Attached is an image which reflects the level of field coordination ongoing. We have had the opportunity to review timeline and budget and found that we are slightly ahead of budget and behind on schedule. We did have some unanticipated soil removal costs, but less than we had budgeted for as contingency. The trucking delays for soil export did compound into what looks to be about a month delay. We will look for opportunities to make it up. Another highlight from this month was a visit to the off-site factory where our wall panels are being pre-assembled. Panelization of walls saves time on site and generally increases quality and consistency. There is a lot of talk in our industry about “modular” construction, which many empty promises. Wall panels are the one area where we do see a clear advantage. |

Wall panels at the Dayspring factory getting ready for Cornus framing. Each is built to plan and the digitally marked for placement. They will get flown by crane up to the readied decks and secured in place by a framing crew. This saves about four days per floor of time and improves quality. It is neutral on cost

Acer House

114 unit equitable development in Seattle, WA

It’s been a while since we’ve had an update on Acer House! We have mostly been waiting for progress on our rezone. We had a big milestone in the form of the Hearing Examiner hearing on July 19th, and expect a result back any day now.

As a reminder, our rezone was approved by the Seattle Department of Construction and Inspections. There is an automatic appeal to the Hearing Examiner, and then a final decision by City Council. We remain highly optimistic, especially given the strongly pro-housing bent that Seattle politics has taken recently. We look forward to informing you the moment we get more news!

Portland Apartments Portfolio

250 Eco-Housing portfolio in Portland, OR

It’s been a busy week in Portland as our growing team continues to lease in a tough market. We are also growing our scale by collaborating with a partner to take on management of another building in the lovely Southeast region.

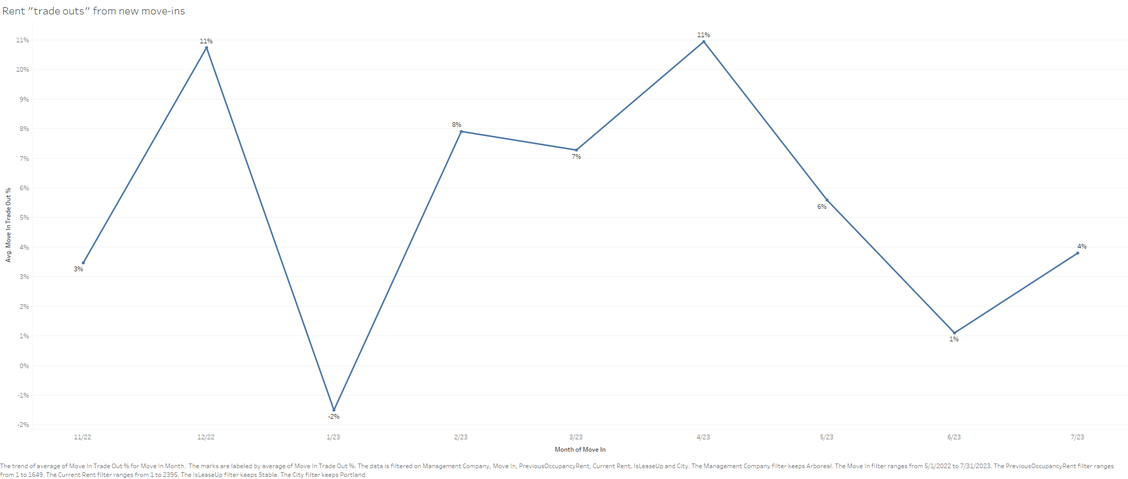

Our buildings are now largely full and so we are closely tracking lease-tradeouts — the growth in rent that you get when a tenant moves out and a new one comes in. Portland has been around 5-6% so far this year, with some noise that can be expected from our small sample size. August and September will be major leasing months and set the tone for the next year.

Lease tradeouts in our Portland portfolio continuing to trend positive

Seattle Apartments Portfolio

567 Eco-Housing portfolio in Seattle, WA

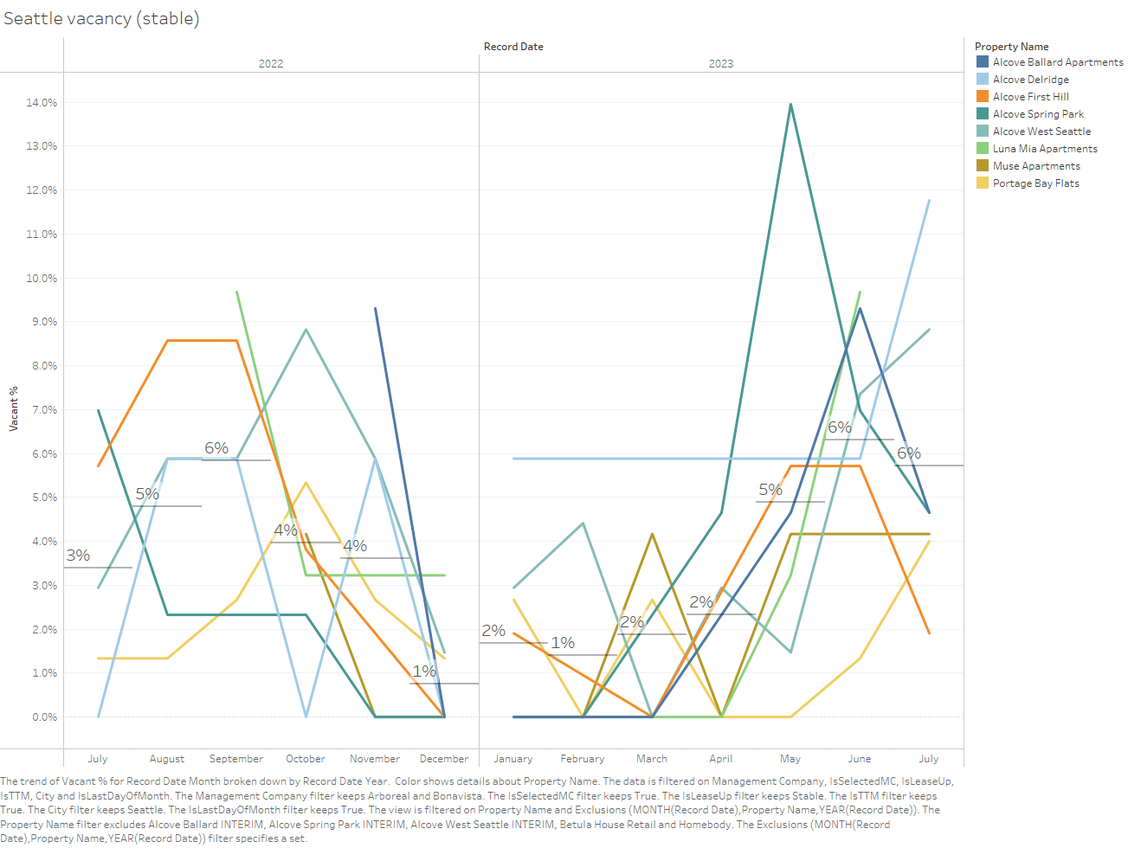

The Seattle market remains strong. While we saw fewer move outs in April/May this year, we did see a significant increase in July/August. Fortunately, our leasing team is world class. We have been able to keep pace and manage vacancy to around our summer target of 5-6%. We see no reason not to be able to return to our stable rate of ~3% in the next few months

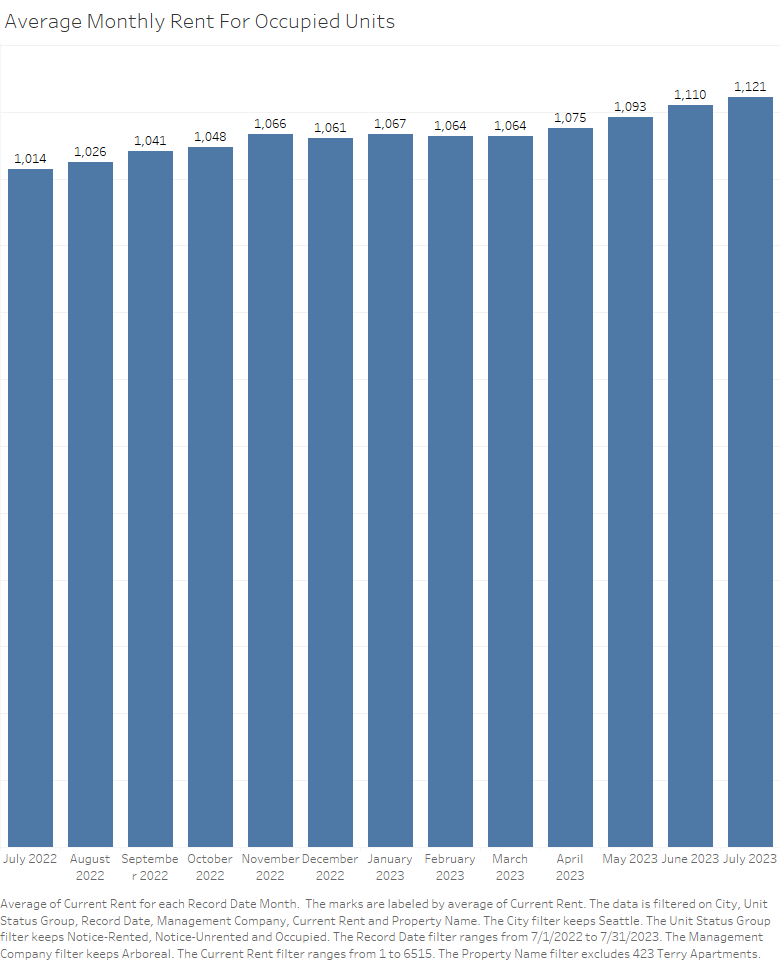

We have been able to maintain a steady rent growth through this period, in line with inflation and median income growth. Year on year we saw about a 9% increase in effective rent per unit, whereas Area Median Income growth was about 8%. Our average rent of ~$1,100 is affordable to someone earning less than 50% of the Area Median Income, or about $48,000 per year

Thuja Apartments — first building!

We are thrilled to have closed our first acquisition for our 3rd fund, Thuja Apartments.

The first building, which we are calling Columbia Apartments, is a former drug court site which we are turning into affordable housing. It is a beautiful 1910 brick building on a prominent corner of Columbia City. We will be remodeling 28 sleeping rooms and 6 shared bathrooms, with a target rent of about $845 / month (30-40% AMI).

The location is truly A+, which is as much of a factor for affordable housing as it is for market rate. Because premium neighborhoods such as Columbia City are often overlooked by affordable housing providers, there is usually tremendous demand. There will be nothing else available in our price point for 1-2 miles.

Our construction calendar is very tight — we closed last week on Thursday, completed demolition this week, and plan to have new flooring installed next week. After that we will be painting, installing the bathrooms and on to leasing by September 1st.

We acquired the building from the prior non-profit owner who lost their funding contract with the county. The seller appreciated our mission and worked with us through a difficult closing. Our purchase basis is low, and we see only modest investment needed. We expect to be able to generate an attractive cash yield shortly, with long term upside from the excellent location.

The Thuja fund is about to open for fundraising! Yes, we needed to close on Columbia ahead of the main fundraising, which got delayed due to some summer vacation plans. We are reaching out to our investors this week to discuss Thuja and look forward to speaking with you!

Interior of a sleeping room with the old flooring removed. Note the high quality kitchen still in place. Cabinets will be resurface and pulls upgraded, but not change needed to the counterop or hardware.

Thank you!

As always, thank you for your support and please do not hesitate to reach out with any questions!

Ben and the GE/Arboreal team.

Ernesto and Saul waiting for me to get out so they can get back to demo’ing this old bathroom

Copyright (C) 2023 Great Expectations LLC. All rights reserved.

Our mailing address is:

Want to change how you receive these emails?

You can update your preferences or unsubscribe

Recent Comments