As we wrap up our second full year of operations, we feel especially lucky to have built a community of investors, partners and employees who support our mission of above market returns and below market rents.

This letter is a slightly abridged version of what we sent to our investors to sum up our year. It has a short update on our progress in 2022 and goals for 2023. We also include a discussion of of our advocacy, social impact, and sustainability.

Company snapshot

Together we have achieved some important milestones this year as we have grown to:

-

An amazing group of over 130 investors, across five syndicated funds, with over $50M of equity under management

-

10 stable properties with more than 500 fully leased apartment homes

-

Eight development projects, totaling over 600 additional homes, of which two projects with 250 homes are now under construction

-

A team of 10 full time, amazing, committed professionals who make up what is now clearly the leading operator of unsubsidized affordable housing in our market.

-

Average “AMI” of 50-60% — meaning that people earning no more than 50-60% of the Area Median Income can afford to live in our homes

-

A reduction in carbon emissions of over 500 tons per year, due to the reduced footprint of our eco-housing residents vs people living in traditional housing

Nationally, 2022 was a challenging year for multifamily real estate, in large part due to the continued fall out from the COVID-19 pandemic. Many residents are still struggling economically. The landlord-tenant legal landscape has completely changed, and we have seen the fastest increase in interest rates in modern history.

While these trends certainly affect us, we are proud that we have navigated them well and have been able to maintain stable distributions on all of our stabilized funds. We maintain the three characteristics required in cyclical industries: operational excellence, conservative financing, and stable cash flow. We feel well positioned to navigate the uncertainty that is certain to come in 2023.

2022 Highlights

We are proud of our track record, including these highlights:

-

Development, where we were able to break ground on our 199-unit Cornus project in Tacoma, closing on what we believe is the last favorable financing package of the business cycle (weighted cost of construction debt between 6-7%)

-

Acquisitions, especially of our Picea fund where we closed on the last of over 280 affordable apartments

-

Property management, where we have been able to rapidly stabilize our acquisitions, achieve near-zero vacancy, and provide excellent, affordable housing to our residents

-

Advocacy, where our focus area of promoting the role of the private sector in affordable housing has led us to local prominence and several notable appointments

2023 Outlook

As we look forward to 2023, we believe there will be opportunities for targeted investments, especially in the second half of the year once the interest rate environment stabilizes. We anticipate the following projects to be open for investment towards the end of 2023:

-

Araucaria Garden, our 17-home “missing middle” family housing project across the street from Seattle in Tukwila, WA

-

Acer House, our 114-home equitable Opportunity Zone development in the Central Area of Seattle

-

1-2 targeted acquisitions, where we partner with motivated sellers to acquire properties where we can deliver on our strategy of below market rents and above market returns

-

Arbutus House, a 300+ home Opportunity Zone development in Tacoma where we will be seeking investment partners for entitlements late next year.

-

Abies House, a ~150 home Opportunity Zone development in Spokane, WA where we are partnering with a local landowner to develop much needed workforce housing

In addition to executing these investments, we hope to continue to build the “health” of our business. Our priorities include building on the scale and strength of our property management capabilities, building deeper partnerships with public and non-profit sector funders, and exploring new development types such as SROs and further missing middle housing.

Fund performance review

Slide through the images below for a brief summary of the performance of each of the five syndicated funds we have closed and deployed to date

-

Picea Apartments – Seattle Eco-housing acquisition

-

Fraxinus Apartments – Portland Eco-housing acquisition

-

Betula House – Seattle OZ development

-

Cornus House – Tacoma OZ development

-

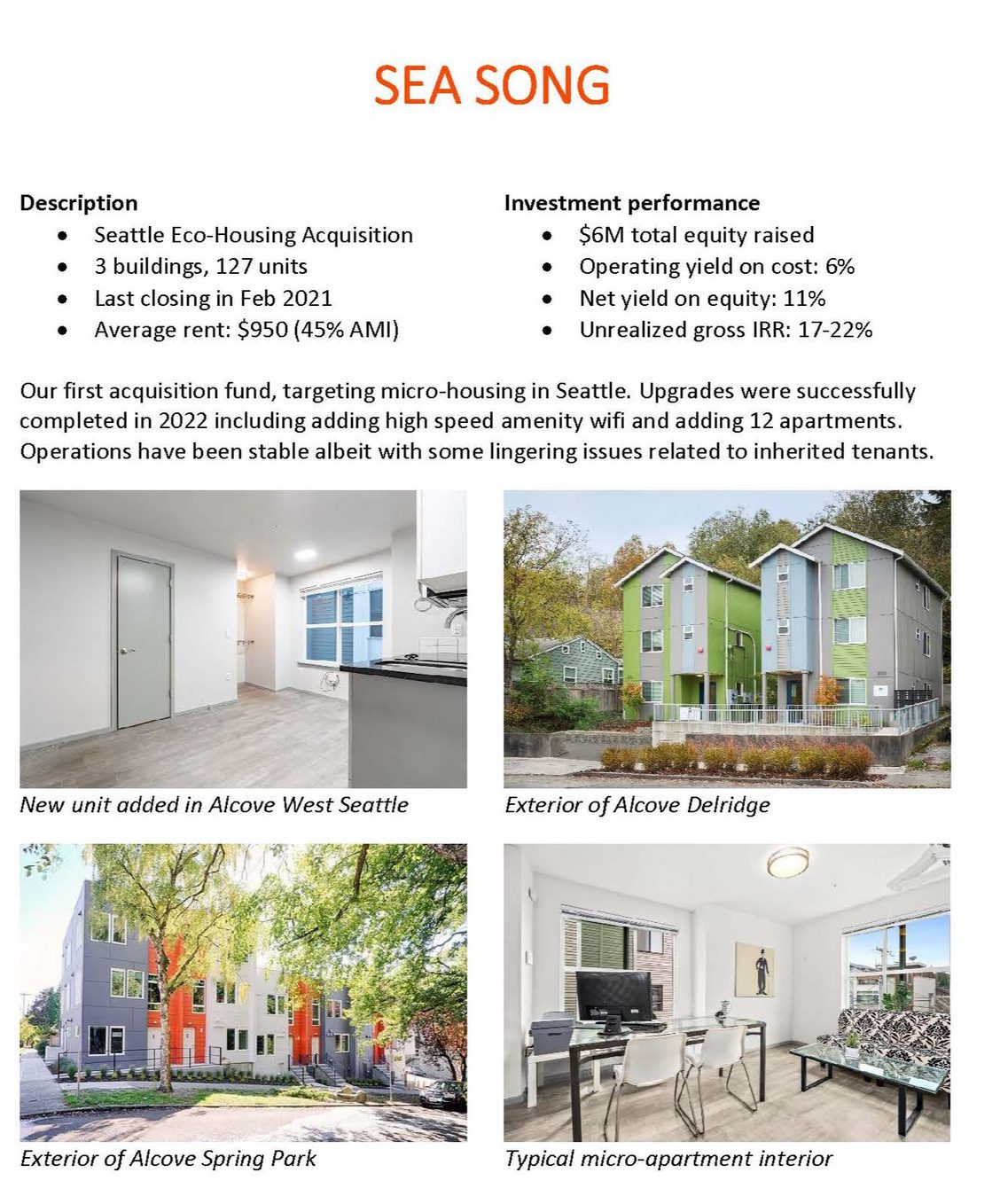

Sea Song – Seattle Eco-housing acquisition

Not included are our projects currently in entitlement, some of which do have syndicated equity investments, or our projects still in feasabilty.

Advocacy and Impact

Our vision is to shape a housing industry that brings more private capital to the critical issue of the lack of affordable housing. We will achieve this in part by delivering on our mission of above market returns and for below market rents, but also by educating others and paving the way for a deeper partnership between the public, non-profit and private sector in housing.

Partner for Voucher Programs

We believe we are unique in how we embrace voucher-based rental subsidy programs, which currently support about 10% of our Seattle residents. Voucher programs are when a 3rd party, usually a Housing Authority or a publicly funded non-profit provide ongoing rent subsidies for a low income renter. Many landlords do not like vouchers because of the additional complexity, but we view it as part of our mission to embrace vouchers as an essential way of increasing affordability.

We currently have vouchers from several programs including:

-

Section 8 Housing Choice Vouchers for low-income renters

-

CARES Act Emergency Housing Vouchers for formerly homeless people

-

Housing and Essential Needs (HEN) Vouchers for permanently disabled people

-

King County Mental Health Court Vouchers for people recovering from substance abuse

-

Rapid Rehousing Vouchers for people at risk of homelessness

Our goal is to increase voucher support to 15% of our residents by the end of 2023. To do this, we need to build continue to build relationships with voucher providers and advocate for an improvement of the voucher programs, including in critical areas such as financial stability and conflict resolution.

Eviction Prevention Programs

Eviction is a serious risk for low-income renters and we do everything we can to avoid it. We are lucky to work in cities where there are significant eviction prevention resources, including cash subsidies that are available. As with many anti-poverty programs, these resources can be very difficult to access for those who need them most. We have developed an expertise in helping our residents navigate these programs when they need it.

We have had 40 residents fall significantly behind on rent at least one time this year (more than one month). Of these, 25 were able to recover on their own, and 14 were able to get public assistance to help them get back on track. One moved out under a negotiated settlement.

We had to conduct two actual evictions this year, one due to criminal activity and one due to lack of responsiveness from the resident. Evictions are an absolute last resort for us, and we do not evict for financial reasons when there are resources available.

Leadership in the Community

We are proud to have been building a name for ourselves as affordability-focused private developers. In part because of this, we have repeatedly been asked to serve on panels and to comment in the press. I am particularly proud of three public roles we’ve taken on his year:

-

Seattle Mayoral Transition Committee member, focused on Land Use

-

King Country Regional Homelessness Authority Implementation Board Member

-

Seattle Design Review Board Member

We are active in the community to advance the role of the private sector in addressing our community’s housing crisis. We attempt to be consistent in delivering a consistent message:

- More housing is needed to reduce housing costs, unlock social stability, and end homelessness

- The private sector is the only realistic way to scale the needed housing in the foreseeable future

- The public sector must shift to a pro-development stance, including by removing regulatory and cost barriers to new housing of all types

- In turn, the private sector must do more to play a pro-social role, including embracing tenant protections and focusing investments on lower- and middle- income markets

- For extremely low-income individuals, where ability to pay is below the operating cost of even the most affordable private apartment, the public, non-profit, and private sector must all collaborate to provide solutions

Climate Resiliency

We are dedicated urbanists and recognize that among the many benefits of urban living is increased climate resiliency. A recent energy audit conducted by a third party showed that our energy usage for Alcove First Hill, a typical building, is under 1.0 Metric Tons of CO2e per resident per year.

This is compared to the national average of 3.2 Metric Tons of CO2e per resident, or the Seattle, WA average of 1.85. Seattle is lower because it is more dense than the national average, requires less air conditioning, and we pull our power largely from sustainable hydro sources.

Seattle is generally a more expensive market than the national average, and most Americans cannot afford to live in our climate-friendly environment. Our eco-apartments, both economically and ecologically sustainable, are thus doubly important. For this reason, we set our carbon benchmark at 2.5 MT (average of Seattle and the nation), and assume that when a resident moves into our apartments, their residential output reduces by 1.5MT. Thus, our 500 residents represent a reduction of 750 MT CO2e/year.

This analysis completely excludes the impact of reduced vehicle ownership and as such is conservative. Our buildings all have no parking on site, which discourages car ownership. Vehicles are the single biggest source of emissions in our region. We will aim to include them in future analysis.

Thank you!

Once again, we’d like to offer my most sincere thanks to all of you for your friendship and support as we have built our mission-driven business over the past few years. We look forward to working together in 2023 and byeond!

Recent Comments